Tax Strategies, Tips For The 2021 Tax Season

You could be looking forward to that wage increase. Or, you could be looking forward to a business deal that will bring in tens of thousands of dollars. You must be excited about the prospects of the year ahead. But remember this, when 2021 is over and we welcome the year 2022 into our lives, you will face an obligation to file your 2021 tax return.

I can attest to this – whatever you shall do with your new income may not result in anything pleasant if you do not position yourself strategically in terms of taxes. And, to secure this strategic position, you must start working on a tax strategy for 2021 taxes now. When everyone is busy filing their 2020 returns, and it’s all they can think of, don’t lose your guard. Quietly start making moves to reduce your 2021 tax bill. If you succeed in starting now, I can only see you smiling come next year’s tax filing season.

But talking about strategies alone won’t help you. Here, I present some strategies, tips, and information that will help you be well equipped for 2021 taxes.

Don’t be on the losing side

Whether we think about it or not, each tax season presents two groups of people. The first is made of those not working with a tax professional, and the second, those that hire tax professionals. Tax professionals are people like me, experienced tax practitioners who help you plan and prepare your taxes. And in this article, we are interested in the planning phase because that is what we want to help you do for your 2021 taxes.

Without a tax professional on your side, you may fail to strategize your taxes at all, or you can try but do it all wrong. Either way, you can easily lose 45% of your income to taxes.

But, by working with a tax professional throughout 2021, come next year when you file your return, you will be facing significantly reduced taxes to pay the IRS. Therefore, the message here is, talk to us so we become your tax professionals now. Location is not a problem; we have clients all over the country. We have tons of strategies to help your business succeed through taxes.

Understand your tax bracket

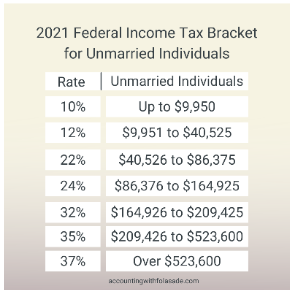

Each year, the IRS releases information on new tax brackets. And honestly, you can only plan and save on what you are fully aware of. It will be of great help to you to know which tax bracket you fall on.

Remember, our tax system is progressive, so you pay taxes according to what you earn. More so, your social status contributes to where you stand, for example, single or household head.

Below are taxes for unmarried individuals earning different incomes.

Married individuals will be taxed according to the chart below in 2021.

Heads of households filing 2021 taxes will be taxed according to the chart below.

Know your deductions and credits

Besides just knowing your tax brackets, having full knowledge about tax deductions helps you to strategize your taxes.

So, let’s talk 2021 standard deductions on your taxable income. Single filers, couples filing jointly and household heads can have a standard deduction of $12,500, $25,100, and $18,800, respectively. A single person with an income of $45,000, after applying the standard deduction, will owe the IRS $9,900 [($45,000-$12,500) multiplied by 22%}

But, being tax professionals, we always encourage working with a tax professional because we help you implement itemized deductions. They result in more tax savings than applying a limited standard deduction. We also help you gain tax credits which result in a more favorable dollar-for-dollar reduction in your taxes. For example, tax credits of $3,000 alone, without even thinking of deductions, reduce your tax bill by the same amount, which is more than the $2,761 saved using a standard deduction.

Moving on to tax credits, these are some popular tax credits to take advantage of for the 2021 taxes. They seem like they are plenty, and even complex, but I will help claim them.

There is the Adoption credit; American opportunity credit; child and dependent care credit; Child tax credit; Credit for the Elderly or the Disabled, Earned income tax credit, Lifetime learning credit; Residential energy tax credits and Saver’s credit.

Popular deductions include; Capital loss deduction; Charitable contributions; Home office expenses; Medical expenses; Mortgage interest, and Property taxes.

Start keeping tax records now

Tax records are your receipts, invoices or any documents that prove transactions or donations you did throughout the year. Now, deductions and tax credits arise from many of these transactions. So, you must show them to the IRS so they know those transactions really took place.

If you are to claim any deductions in 2021, start keeping records now until next year when the filing season opens.

While working towards filing 2021 returns, don’t discard previous seasons’ tax records because the IRS typically takes 3 years to decide to audit you. This, in case it happens, should find you with correct records intact to prevent further problems for your business.

More tax tips

If you own a small business, hire your child now so that by next year, they would have worked a full year for you. That’s a good tax strategy that will reduce your 2021 taxes.

If you are over the age of 18, start contributing to your retirement account now. That’s another tax strategy that is going to help you reduce your 2021 tax bill.

Do things differently for your 2021 taxes. Don’t do any shady stuff like claiming someone else’s children. Also, for businesses with home offices, to claim your home office deduction in your 2021 taxes, make sure that, starting now until in 2022 when you file, you exclusively use a certain space in your home as a business office. Be consistent in this, otherwise, they won’t allow you to claim this deduction!

More so, you must never try to read the tax code, thinking it will help you save money through taxes – that only adds a lot of work for your busy life. Hire a tax professional like me today and see how good that will work out for you when filing next year’s taxes. Give me a call so we get started.