Here is How the IRS will Tax your Cryptocurrency in 2022

The government is not sleeping while the world advances. It is busy sniffing around, ensuring that it is updated on all economic activities around the country. One of the notable developments in the last decade is the rise in the use, buying, and selling of virtual currencies, which many know as cryptocurrency. However, it benefits you to know the difference between cryptocurrency and virtual currency. We spoke about these two definitions in our previous post about cryptocurrency taxes that are coming up. The government knows about cryptocurrency and that millions of Americans trade in one or more cryptocurrencies in a single year. That is why they want they share (in taxes) of what happens in the world of crypto.

Also, in our previous post, we did mention that the IRS does not just seek to tax everyone who has investments in cryptocurrency. Instead, they will tax you on the transactions you make in any virtual currency. Therefore, in this article, you will understand how the government will tax your cryptocurrency in 2022 and beyond.

How will the government tax your crypto?

This subject has been highly discussed by several taxpayers across the country. As a tax preparer, I have often heard this more this year than the prior tax seasons. This is because the IRS is getting serious about this, and many taxpayers are getting scared of doing something wrong. Therefore, knowing everything there is about how IRS will tax your cryptocurrency will protect you from this kind of fear.

IRS does not tax you when you buy crypto

When you hear about cryptocurrency for the first time and decide to buy, the IRS will not ask you to pay tax on the amount you purchased the crypto. But you would have made an investment using your money. This investment is treated the same way as property or assets. In IRS books, you are just like someone who has bought shares on the stock market. But these crypto transactions have long been going under the radar because of their cryptic nature. It has not been easy for governments to track all cryptocurrency activities, hence the rampant ‘secret’ buying and selling of cryptocurrency or digital currencies.

So, when you buy Bitcoin, Dogecoin, or any other cryptocurrency today, do not worry about paying tax on the purchasing amount. However, you should immediately start getting some education on how the IRS taxes cryptocurrency because you will eventually sell or exchange your Bitcoin or Dogecoin for something, be it cash, goods, or services.

IRS will tax your gains on cryptocurrency transactions

The IRS will tax your profits or gains on crypto investments. But you must also declare your capital loss on cryptocurrency transactions.

When an investor buys an asset, keeps it, and then sells later, they either make gains or losses on their investment. The same happens with your cryptocurrency transactions. We mentioned above that when you buy crypto, IRS will not tax you – because that is an investment. But there will come a day when you sell your assets or investments to take the profits or avoid further loss. You may even sell your investment just to buy something. That is the point when the IRS wants you to declare your capital gains for tax purposes.

Now, capital gains tax is governed by a few sets of rules. These rules are around the question of whether your capital gains or losses are short or long term.

Short-term capital gains arise when you profit from selling the cryptocurrency that you owned for one year or less. These short-term capital gains are taxed at your ordinary-income rate.

On the other hand, if you bought or received cryptocurrency and held it for more than one year when you sell it, any profits are typically long-term capital gains. These types of gains are subject to long-term capital gains tax rates.

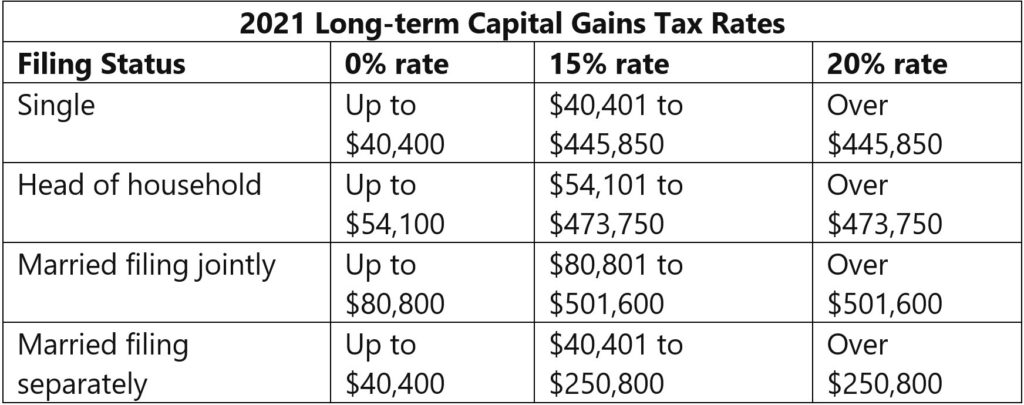

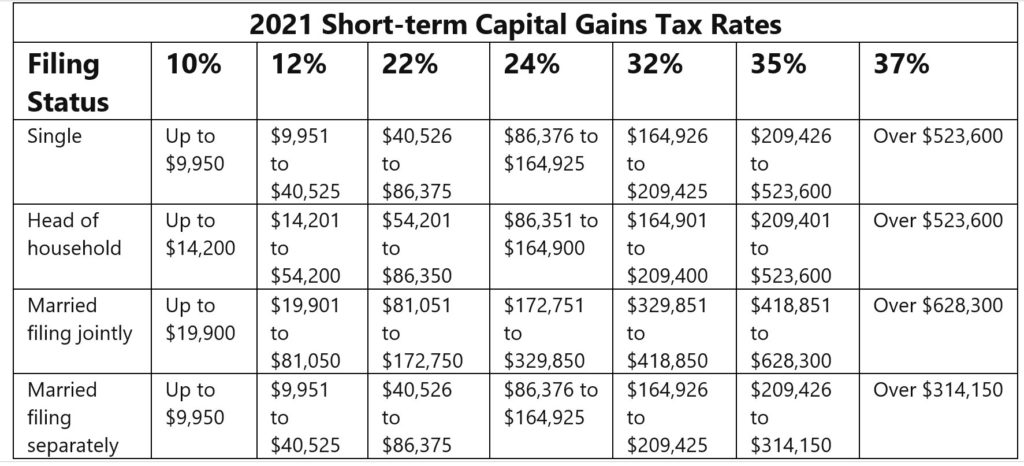

We are currently in the 2022 tax season, filing returns for the 2021 tax year. Based on this, the tax return you are currently preparing will be following these rates:

Above are long-term capital gains tax for tax year 2021. These are the ones that will determine how much you owe the IRS on your cryptocurrency transactions that resemble trading for profit.

The above are short-term capital gains tax rates for tax year 2021. IRS will use these rates for your crypto investments held for a period of one year or less.

What are complications likely to arise when dealing with cryptocurrency taxes?

In conclusion to this article, I would like to point you to a few issues you should really take note of.

First, you may earn cryptocurrency based on various activities. It is not always the case that you buy crypto and then sell it. You may earn it as wages and salaries, or you may sell your goods and services through crypto. That is when the complications arise.

If you earn crypto, the amount you received today – on your pay date – will be taxed as income because you made it through providing labor. But if you keep the crypto for six months and it gains value, then you must pay capital gains tax on the difference. For example, you provide work for $300 and are paid in Bitcoin. If you keep the Bitcoin for two months and the price of Bitcoin rises to $450, it means your salary has eventually turned to $450, the value of Bitcoin on the day. If you sell the Bitcoin this day, you will be required to pay income tax on the $300 original amount and then pay short-term capital gains tax on the remaining $150 gain.

The same applies when you exchange or sell your goods and services in crypto. Keep in mind the income from selling and the capital gains or loss from the appreciating value of the crypto in the crypto market.

For all this to not confuse you, always keep a good record of your crypto transactions. Clearly indicate your crypto income and capital gains. I am still taking clients for the 2022 tax season and would like to help you if you are struggling with such crypto matters. Call my team at (202)618-1297 to book a quick tax chat with me.