What Are The Proven Tax Tips For 2021 Tax Season

The 2021 tax season will have surprises and mistakes too, especially for individuals and small businesses without a tax professional. There are just plenty of reasons to believe so. For example, COVID-19 relief measures that could cause tax filing mistakes and the new Biden Administration tax changes.

All the possible changes create chaos, and with it comes the possibility of making mistakes. More so, chaos creates an opportunity for fraudulent tax practitioners. This all calls for vigilance on everyone that will be filing 2021 taxes. It also calls for taxpayers to employ as many tax tips for the 2021 tax season as possible.

Getting tax tips for the 2021 tax season correctly

Firstly, your aim is not just to file your 2021 tax return correctly but also to reduce your tax bill. You also want to increase your tax refund using tax credits and deductions available. Remember, to do things well, you start by defining the goals you want to achieve. In this case, we are saying it’s reducing your tax bill and increasing your tax refund.

So, what must you do to achieve these goals?

-

Hire a tax professional

I put this one first because it’s very important. The reason here is that, as tax professionals, it’s our job to know both the current tax code and the new tax changes every year. So, who better to employ tax strategies to reduce your owed taxes and increase your tax refund?

Another bonus point is that we, tax professionals, are all accountants. And from my experience, we help many businesses grow by helping them invest their tax refunds in several ways. We also use our accounting skills to look through your finances and coach you on how to grow your business from the intelligence we gather in your books. This surely makes picking a tax professional like me today the best decision you can make for your business or as an individual. We are definitely not like TurboTax because we will work to know your business and provide unique assistance.

-

Don’t be led by fear, but follow the lead of your tax professional

If you work with a tax professional, it’s best to follow their lead and not be afraid of anything. If you do not have a tax professional, also, don’t be scared. If you do things right, the IRS won’t audit nor penalize you. One thing for sure is you might lose thousands of tax credits and deductions because some of these things are best spotted by tax professionals than anyone else. So, you are better when working with one, be it in your state, for example, a tax professional in Maryland, or, it can be anyone around the country.

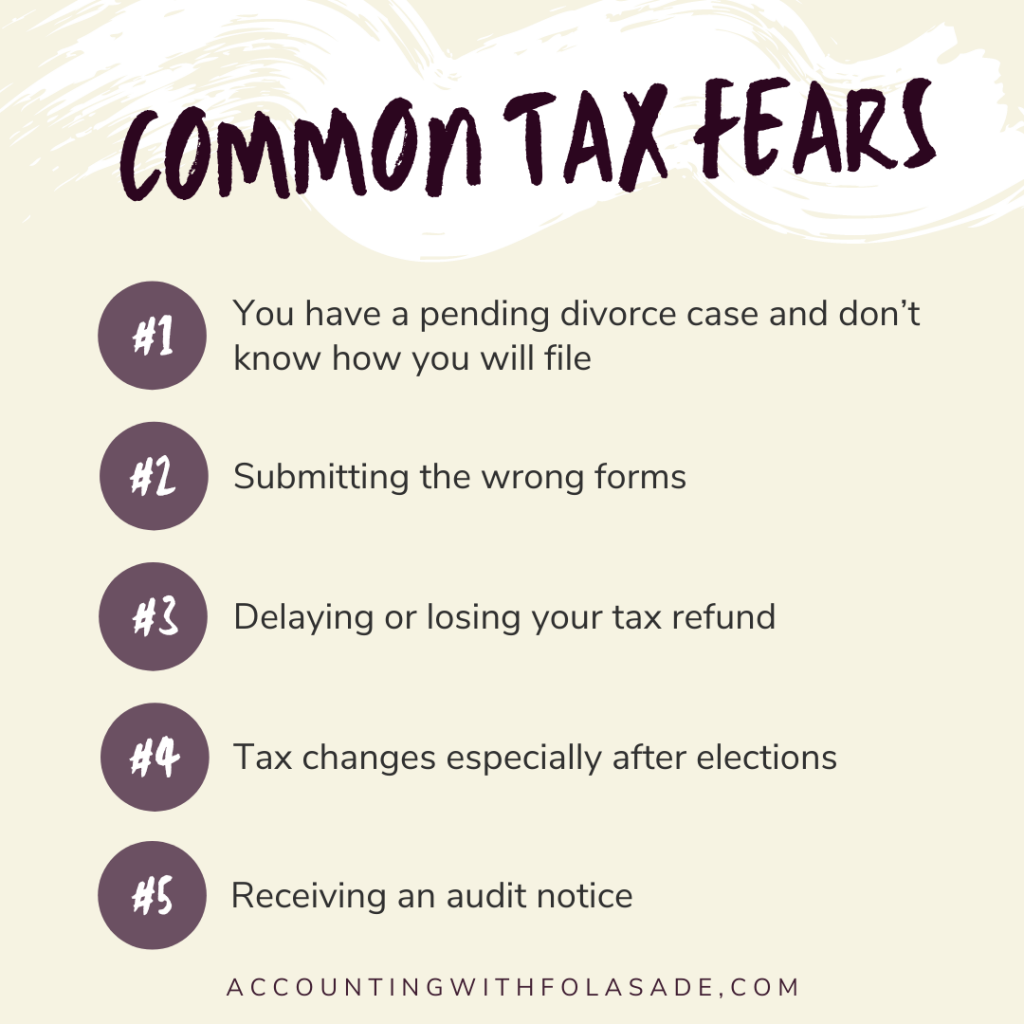

Usually, these are fears of an average taxpayer:

I understand the above fears, but if you run scared even before you start doing paperwork, that increases chances of making mistakes. And given 2021 tax changes, the last thing you want it to be in a state of fear.

-

Understand how PPP loans work

Already, that’s one huge change for the 2021 tax season. Small businesses are set to get the second round of PPP loans. And who knows, the pandemic still rages on, which could see another round coming. Therefore, it helps that you understand how these works. This information helps you take full advantage of the program and pay reduced taxes.

Tax refunds and how they help you or your business

For the 2018 tax year alone, the IRS issued more than 111.8 million refunds, with taxpayers receiving an average payment of $2,869. We already mentioned that one major aim of an average taxpayer is to increase their tax refund. This means that 2018 average of $2,869 can be grown over the years.

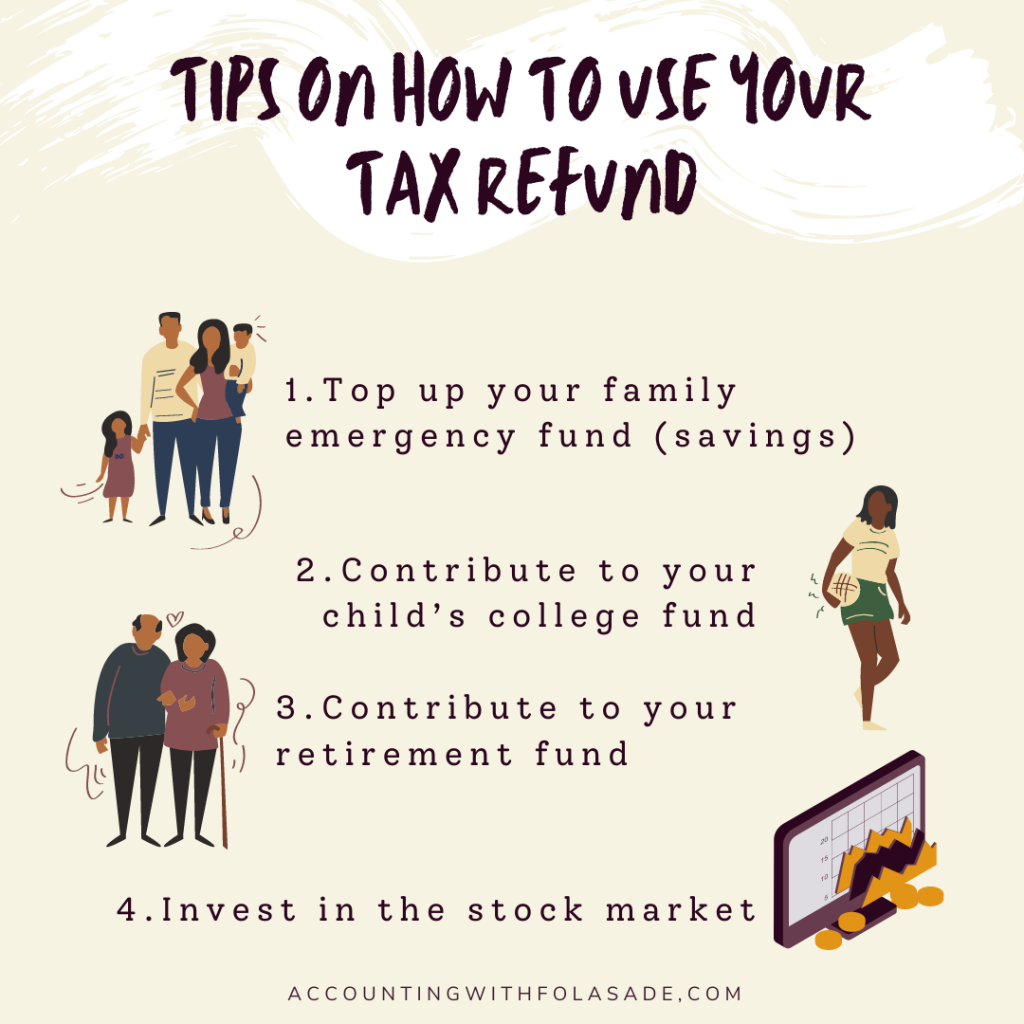

However, what we do with that money differs, but we can do better and use it to grow wealth. Building generational wealth using taxes is a matter of discipline and consistency. And below, we look at how you can use your 2021 tax refund to that purpose.

Below are some ways you can use your tax refund money to improve your life.

-

Contribute to your child’s college fund

Millions of Americans are burdened by repaying college loans for several of their adult lives. While other rich kids are investing their money, they will be busy repaying the college debt. Therefore, you can avoid this by using some of your tax refund to contribute to your child’s college fund. Doing this for several years before they go to college can make your baby walk into their first job debt-free!

While at it, you can also hire your child when they are young and teach them to also contribute to the same college fund. It significantly grows your child’s chances of not having to borrow for education.

-

Invest in a business

Don’t’ go to the big banks and get slapped by unfavorable interests on business loans. Your tax refund can be your seed money for your new business. Remember, through organization and a good structure, you can grow your business from any size to something huge. Just be consistent in investing your tax refund in the business every year.

-

Invest in the stock market

This is a very good strategy to use since investments you make there can quadruple over the years or more. Your aim in investing here is for long-term gains. And many rich families do this and earn profits enough to buy real estate after a few decades. And here is an upside when it comes to stock market investing, profits here are taxed favorably. This means you will pay little to no taxes from the profits you make.

Conclusion

In the end, we want everyone to know that all generational curses can be broken. We just need to get our taxes right and work with tax professionals that help us build wealth. We have over 40 million black people in the US, which is huge enough to form a powerful economy of our own – as long as we implement what this article carries and more. Find out how we can help you by contacting Suncrest Financial Services. We won’t stop until all our followers enjoy the wealth they build through tax strategies.