What is the importance of tax planning?

We definitely cannot speak about a proactive tax strategy without mentioning tax planning. This is because whatever tax strategy you implement results from a tax plan that your tax professional presented. Therefore, tax planning is an analysis of your financial situation or income sources to ensure that all things work together to make you pay the lowest taxes possible.

So, if a tax professional goes through your finances before you pay federal taxes, that is tax planning. This process aims to identify elements of your finances that can be used to earn tax deductions and credits. These will, in turn, reduce your tax bill and increase your tax refund.

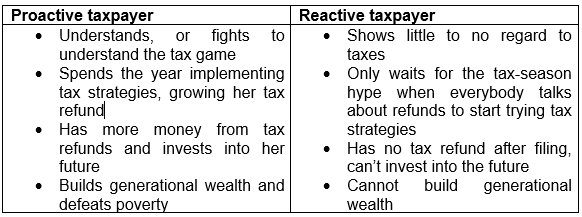

What is the difference between a proactive taxpayer and a reactive taxpayer?

Having defined tax planning, we can now move ahead to define proactive and reactive taxpayers. You know, the IRS uses your adjusted gross income (AGI) to determine how much taxes you owe? Therefore, tax planning aims to reduce this AGI in a single tax year, or calendar year, using various means, including making certain investments. A reduced AGI equals less taxes owed.

With that being said, a proactive taxpayer spends the year implementing tax strategies that reduce her AGI. On the other hand, a reactive taxpayer never really does anything during the year. However, she reacts to tax memes posted on Instagram when there are a few weeks left to file tax returns. That really never works.

Why is it important to be more proactive than reactive when it comes to tax planning?

Taxes are a matter of playing the long game. There are no quick fixes if you want to win. Tax credits and deductions you hear people talk about result from the work you do through the year. Therefore, a proactive tax strategy means you are going to implement the actual work from January to December.

Here are two examples: First, if you are to plan your finances well using taxes, you must know your tax bracket. It gives you an idea of how much you are likely to owe at the end of the tax year. So, a proactive taxpayer will research such information by January of each year. She won’t mind even if there is still more than 11 months to complete the tax year. On the other hand, a reactive taxpayer will only ask about her tax bracket when the tax season opens.

The second example is very practical and has financial implications. It involves our lovely educators. Because of the pandemic, they used their own money to buy COVID-19 expenses to use in the classroom. Now the IRS says they can deduct such expenses incurred in a tax year, starting when filing 2020 returns.

So, to prove your expenses, if you are an educator, you must produce receipts of purchases you made. A proactive taxpayer would have long started gathering these receipts for such a time. But a reactive taxpayer will have nothing to prove such purchases. She will try to run around digging into her forgotten papers only now when everybody is talking about these deductions. So, proactive taxpayers keep their tax records in a safe place, while reactive taxpayers don’t keep these records at all.

In the end, reactive taxpayers are always losing money. They have no regard for tax planning. Because of that, they don’t get any tax refunds. At the end, when others have more money to put into saving accounts or are busy with retirement planning, they will have nothing to be doing.

How to start proactive tax planning

Being reactive to tax news is bad. We now know it doesn’t help you grow your tax refund at all. I speak more about growing your tax refund because that should exactly be your aim over the years. If you get $2,000 this year; for 2021 taxes, aim to get $2,500. Keep it growing. Don’t stop until you exhaust all tax strategies out there.

With that being said, here are two ways how to become a proactive taxpayer:

-

Understand the role of taxes in your life.

Many people make the mistake of thinking taxes are just a one-time event between January and April 15. Not at all. You don’t only wait for the rush to catch the deadline on April 15. But all your financial decisions throughout the year have an impact on your taxes – and eventually on your life. How? Taxes are used to build long-term wealth, and it all starts by paying attention to your daily financial behavior.

Seeing things this way makes you not only worry about the 3-months long tax season in a year. But it makes you question every decision you make with your finances daily and see if there is any aspect of tax planning in any of it.

-

Understand the role of tax planning in your life

Tax planning is the key to making the right financial decisions. You know that everything you do must have a positive impact on your long-term finances. If you don’t know where to begin with tax planning, there is an easy way. Start by a simple Google search for tax planning examples or just tax planning strategies for individuals 2021. If you think you need help in this regard, give me a call and book an appointment. I will walk you through our tax planning services. Many people work with us and have been giving us raving reviews because of how much we have helped them start saving and investing into their future using taxes.