Tax Filing Mistakes using TurboTax | TurboTax Trap

Imagine the pain of someone calling your name, asking you to trust that they will freely do something for you only to turn around and let you do everything by yourself? That is one classic example of the pain that TurboTax users go through. It’s called a TurboTax trap! And because of this trap, many innocent people have made tax filing mistakes that cost them their money and time.

Tax filing mistakes using TurboTax

Filing tax returns is no easy task unless if you hire a tax expert to help you prepare your taxes. But there are mainly two types of filers that are tempted to file their own taxes every year. These are individual taxpayers and small business owners. What lures them to such websites as TurboTax is the “Free Filing” tool they sell in their adverts. But we will probe if that is really true.

Many individuals struggle to get it right when they choose to file for themselves. Even as they do, bear in mind that individual taxes are widely composed of W-2s. They don’t have to compile many types of incomes, but they still face difficulties in doing so. Besides individuals, small business owners are also among people that want to utilize electronic filing systems for their business taxes. But even if they do, their pain is even more, given many forms and schedules involved with them. A Business’ earned income could be sourced from many sources, and their expenses are even wider. These result in many reporting obligations as laid out in the tax law – a source of tax filing pains!

Therefore, the need to file their own taxes is the root to mistakes arising from using TurboTax. They won’t notice the TurboTax trap until it’s too late. However, this article is here to help you realize what a mistake that will be to trust a software to prepare your taxes.

-

TurboTax isn’t really free

It’s interesting that, even after the number of people using this software, people still ask if TurboTax is Really Free. Well, this software is really expensive in the sense that you pay a fee, and after paying, you still file your own taxes. I say this because if they can’t prepare your tax documents as what us, tax professionals do, then you are literally doing it yourself. So, in other words, it’s like you are paying twice for a service that you approached thinking is free.

Therefore, that is mistake number one; TurboTax is not free; you pay and gather all documents by yourself. After gathering them, you upload them one by one, something that my clients will never do. By so doing, you lose your money and time. To add to that, you also go through the stress of getting documents together.

-

Is there an accuracy guarantee using TurboTax?

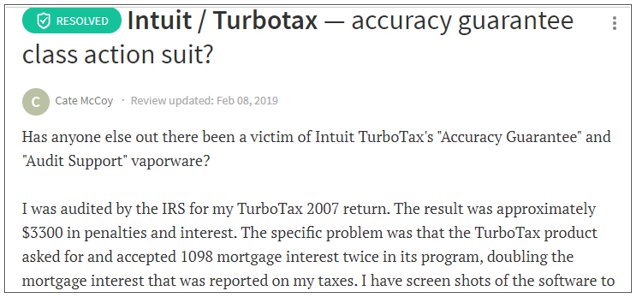

To answer this question, I don’t need to write a lot here. I did a simple search online and stumbled upon something on the Complaints Board. See the image below;

According to the above, TurboTax cannot guaranty accuracy even if they say they do. The pain about these mistakes is that they always come back to haunt you, the taxpayer, not them. If you follow that link with complaints, the IRS ended up demanding penalties from taxpayers, not TurboTax. Therefore, it’s a mistake to assume that this software guarantees accuracy. Your place of safety when filing taxes is with a real human, which is a tax professional!

-

Schedule C Mistakes

I already spoke about how small businesses are tempted to file their taxes using TurboTax. Well, their overlooking of real tax experts (humans) usually results in Schedule C mistakes. How does this happen? Given that self-employed individuals report their business receipts and expenses on Schedule C, some of them don’t have accurate calculations. For example, they don’t know what deductions to legally take. Or, some of them are driven by the fear of being audited; hence they understate their deductions. Some even overstate their deductions, resulting in an IRS audit.

As I have always told my clients, tax calculations involving deductions are complex. For this, you will require the help of a tax expert, not an online software. Remember, the software is only coded in a certain way – and that’s for all filers using it. But, taxes are different. Your business’ earned income is different from another business in another industry. The same applies to your expenses and deductible items.

-

State tax mistakes

Well, this is even more relevant during this pandemic period. Why? It’s because many people have been forced to work from home. And you find that some live in different states to their workplaces. Therefore, you could be required to file taxes for different states.

Federal taxes are the same, but state taxes differ with each state. As such, TurboTax isn’t built to handle multi-state tax return preparation. So, whether you are an individual taxpayer or a small business owner, as long as you are filing for different states, you might be the next to make state tax mistakes using TurboTax.

Here are some questions that people ask about this topic and taxes

1: Can I File Exempt & Still Get a Tax Refund?

Yes and No. Yes if you file exempt but are working and earning low to moderate income – making you qualify for the Earned Income Credit. This credit, and other Refundable Tax Credits, result in negative taxes owed, meaning the IRS must refund you.

It’s a no if you don’t qualify for any Refundable Tax Credits.

2: How to Ask for a Tax Refund

The IRS has two ways that you can utilize to ask for your refund status.

- You can use the IRS Where’s My Refund? It’s the fastest and easiest

You can call the IRS on 800-829-1954

3: Is TurboTax Really Free?

Even though they say they provide a free-filing service for certain individuals, a 2019 research revealed that TurboTax makes it very difficult for its website visitors to access free file. The researchers also put a warning saying ‘TurboTax Free Edition is not always free. It puts many people on track to pay.’

4: How can I be sure my tax information is safe?

Apparently, TurboTax guarantees the safety of your information – but that’s all you have – their word. However, they confirm on their website that some individuals have had their accounts hacked and hackers stole their information. Therefore, protection is not 100% guaranteed.